It has been really a few months of grave frustration for gold/silver holders, so much so that I have got a few rather "depressing" notes from friends and I'm also asked to weigh in on the precious metals.

I think their frustration with gold is that they treat it as an investment with a high expectation for a timely return but it is actually more of a store of value, a real money. For that, the long term holder should not be worried at all for its daily fluctuations. The fundamental reasons for holding gold and silver? With countries, especially the U.S., printing money as fast as possible, ballooning the debt and devaluing their paper-based currencies, gold is the only real money that will last and keep up with inflation over time!

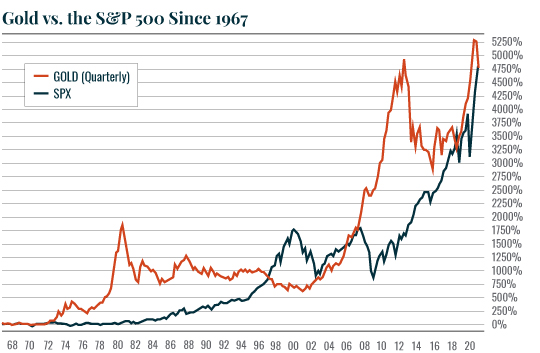

Let me also share some interesting historical performance data for gold vs stocks. If we look at the past 60 years of history, gold has beautifully outperformed the stocks market most of the time.

The only time period in which stocks beat gold was during the Tech Bubble: the single largest stock market bubble of all time. Every other time period saw gold outperform stocks by a wide margin. In fact, stocks only just caught up to gold after trailing it for the better part of the last 15 years!

So, if you are thinking about investing for the LONG TERM, as in "I'm buying gold and likely will not ever sell," then yes, it's almost always a good time to buy gold.

But it does not mean it will just keep going up everyday. It is notoriously cyclic and goes up and down in alteration. After hitting all time highs a few months ago, it is very reasonable to see it take a rest for a while before going up again. I think we are at the eve of its next explosion to the upside, although I cannot tell you the exact moment. No one can but I firmly believe it is coming, probably soon!

I found your this post while searching for information about blog-related research ... It's a good post .. keep posting and updating information. Upstox referral code

ReplyDelete