First of all, some important information to share about COVID virus prevention and treatment. The results from a trial that recently took place in Spain have been published (see here). And the results are crystal clear and impressive about how easily one may take an immediate action to help prevent the infection.

The trial had two arms to compare with:

50 patients that were hospitalized with COVID-19 were given vitamin D

26 patients that were hospitalized with COVID-19 were the control group (no vitamin D)

And the results astonishingly impressive:

Half of those not given vitamin D became so sick that they had to be moved to intensive care

Only one person who took vitamin D required intensive care

The use of vitamin D reduced a patient's risk of requiring intensive care by 25-fold

Wow. One of the authors of the trial, Vadim Backman of Northwestern University, estimates that just by using vitamin D, we can cut the COVID-19 mortality rate in half. While the study is small in size and therefore needs more studies to further confirm, the drastic difference is hardly due to random variations. Since Vitamine D is a basic requirement for the body and it is so cheap, why not to use it as part of ways to prevent the COVID infection?! Of course, be mindful of the dosage and don't take too much. I have seen some experts advising to take 5000 IU Vit D daily for this purpose.

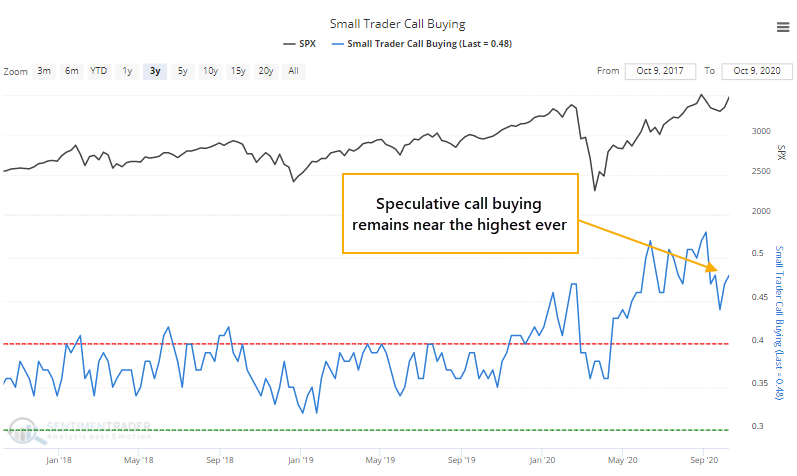

The "stocks only go up" mentality that caught fire in July turned into a raging inferno by the end of August, especially in names like Amazon and Tesla. That triggered warnings about what might happen once some of those options expired.

That preceded a nearly 12% drop in the Nasdaq 100 at its low point in September. While that served to wipe out some of the speculative fervor, it didn't completely destroy it. And now some of those traders are back for more.

Last week, the smallest of options traders spent 48% of their volume on buying to open speculative call options.

When we saw this behavior in August, it was especially worrying because there were consistent signs of trouble underlying the indexes.

By the way, if you are interested in joining my DW investment group, we have set up a Telegram group.

Here is the link for "DW 谈股论金": https://t.me/joinchat/SgYa_xNrjTNHk9cS51ke0A.

Importantly, you cannot join directly via Wechat. Two options:

- When open the blog in Wechat, 点击右上角的三点,然后选在Safari 中open,然后点击the link and then join

- Or copy the link and paste to Safari to open and then join

I am sick to see this blog becomes a Trump propaganda machine.

ReplyDeleteI rarely share my story with people, not only because it put me at the lowest point ever but because it made me a person of ridicule among family and friends. I put all I had into Binary Options ($125,000) after hearing great testimonies about this new investment

ReplyDeletestrategy. I was made to believe my investment would triple, it started good and I got returns (not up to what I had invested). Gathered more and involved a couple family members, but I didn't know I was setting myself up for the kill, in less than no time all we had put ($300,000) was gone. It almost seem I had set them up, they came at me strong and hard. After searching and looking for how to make those scums pay back, I got introduced to (paytondyian699@Gmail.Com) who helped recover about 80% of my lost funds within a month.